Stay Up To Date

We believe in keeping you in the loop with all the latest happenings in our courses and system. On this page, you'll find a comprehensive log of all the exciting changes, improvements, and additions we make to our courses and system. Whether it's a new feature, a course enhancement, or a system update, we've got you covered. Bookmark this page and check back regularly. We're committed to ensuring that your learning experience remains exceptional and that you have all the information you need to succeed.

New Features

New Updates

Resources & Tools

Important Updates

Here are some of the most recent updates we thought would be helpful to take note of

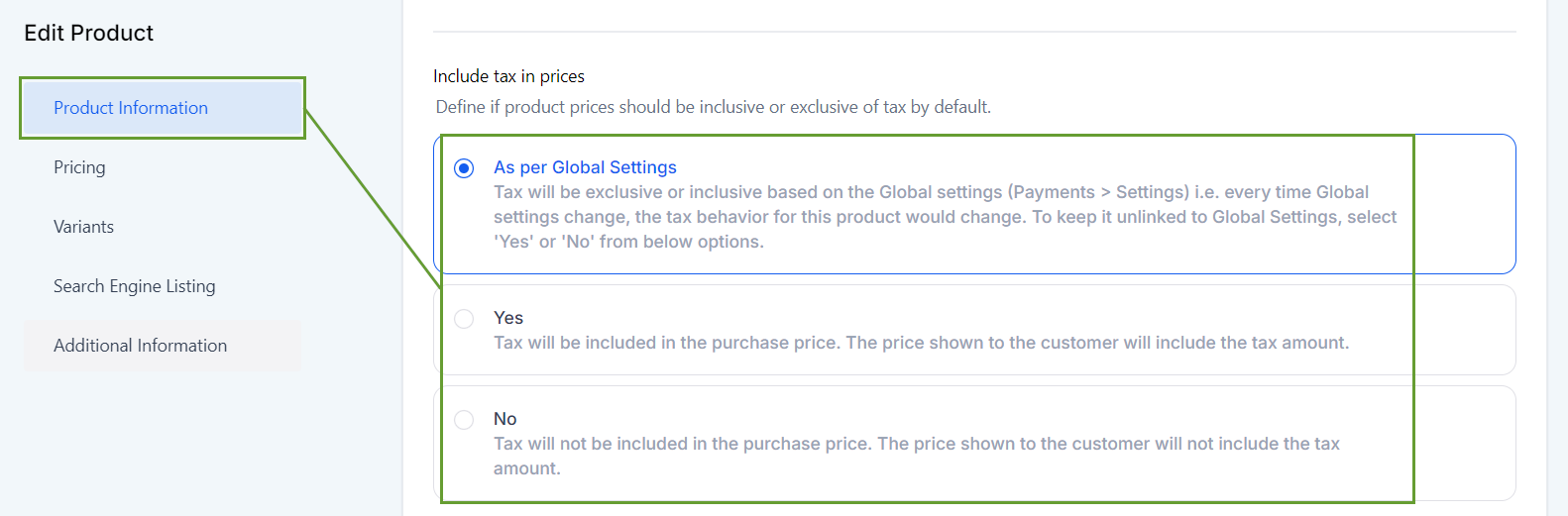

New Feature: Product Tax Inclusive & Tax Exclusive Pricing

Keep your pricing flexible and optimize your tax setup by using both Tax-Inclusive and Tax-Exclusive pricing for your products. This ensures you have options to create pricing strategies that best fit your current needs.

⭐️Why Is This Feature Beneficial To Your Business?

Customer Convenience: Tax-inclusive pricing gives security when completing a purchase. You won't encounter last-minute refusals since what they see is what they pay.

Enhanced Flexibility: This keeps the final decision in your hands by allowing you to switch between Inclusive and Exclusive taxing depending on your needs.

Simplified Accounting: Use tax-exclusive pricing whenever you need to be more dynamic. Allowing you to keep your revenue and taxation separate for more clarity.

⭐️How To Set Product Tax Inclusive or Tax Exclusive Pricing:

Head to the Settings tab inside the Payments section.

Select the Taxes section then select Yes or No under “Include tax in prices” to set your Global Settings.

Navigate to the Products tab to create or edit a Product.

Select your Tax behavior. You can choose between Global settings, Yes for inclusive tax, or No for exclusive tax.

This tool helps you grow your business effortlessly by simplifying tax management for both international and local customers. It allows you to create customized tax setups for each product, tailored to your current needs.